SATHIYA NIDHI CHARITABLE TRUST

A Heart that gives a grows

Participate in our animal-saving mission and help us continue creating a better tomorrow for our rescues.

Welcome to Sathiya Nidhi Charitable Trust

At Sathiya Nidhi Trust, we welcome dedicated volunteers who are passionate about making a difference in the lives of underprivileged communities. Volunteering with us offers a chance to contribute your skills and time to meaningful causes in education, healthcare, and human development.

The Birth of Sathiya Nidhi Trust: .

Sathiya Nidhi Trust was Founded by a group of like-minded individuals from diverse backgrounds, United by a common purpose, they sought to make a tangible difference in the lives of the underprivileged communities in Tamil Nadu. This is the story of how their shared dream became a reality.

Gallery

Mission

To empower underprivileged communities in Tamil Nadu through education, healthcare, and livelihood initiatives, fostering sustainable development and Create equitable opportunities for all.

Vision

Provide accessible and quality education to underprivileged communities through capacity building, career guidance & scholarships, equipping them with knowledge and skills for personal and community development.

Key Focus Areas

Comprehensive Education

Higher Education: The Gross Enrollment Ratio (GER) in higher education in India was 27.1% in 2019-20, indicating that a significant portion of the population still lacks access to higher education.

.

Medical Support

Healthcare Access: According to the World Bank, India had 0.9 physicians per 1,000 people in 2017, highlighting a significant shortage of medical professionals.

.

Sustainable Livelihoods

Unemployment Rates: The unemployment rate in India was reported to be around 6.1% in 2017-18, the highest in 45 years, according to the Periodic Labour Force Survey (PLFS).

.

Volunteer

Education Volunteer

Healthcare Volunteer

Human Development

Event Coordination

Lets make every needy child's life count by contributing to their betterment

Please come forward to donate towards at least one of the above- mentioned expenses and put a smile on a child’s face !

Make a Difference with Your Donation .

Your Generosity Fuels Change and Inspires Hope .

SATHIYA NIDHI CHARITABLE TRUST

Bank details: ICICI Bank

Acc holder name: SATHIYA NIDHI CHARITABLE TRUST,

Ac no: 743605000499,

Ifsc code: ICIC0007436,

Ac type: Current

UPI ID :snct@icici

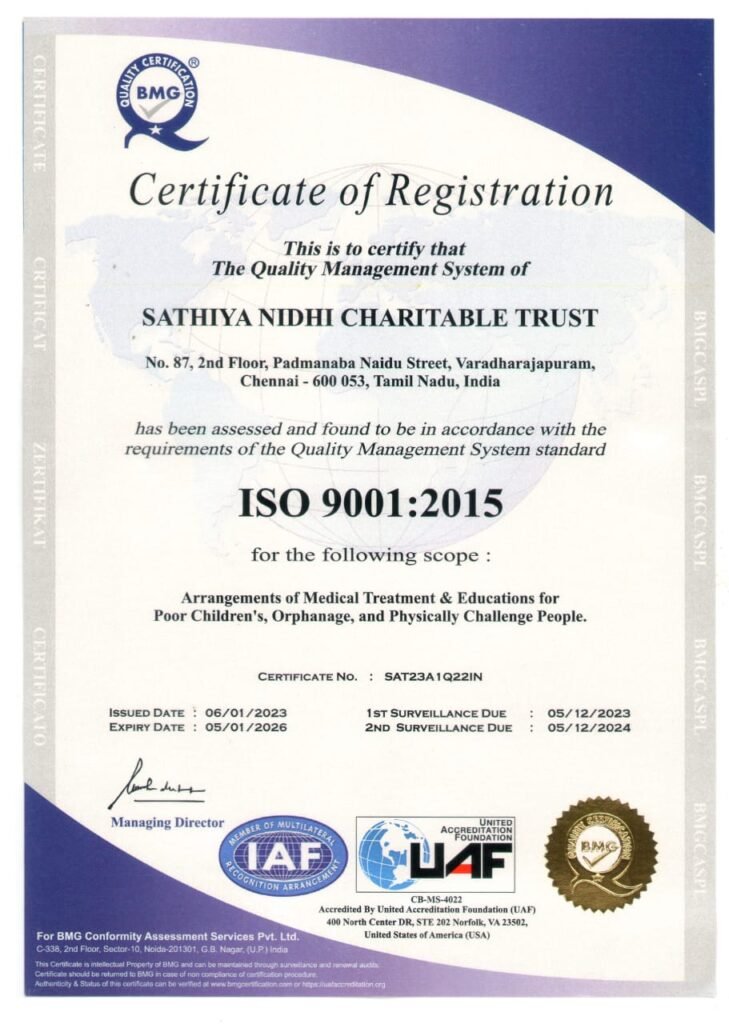

ISO Certificate

ISO 9001:2015 Certification for Sathiya Nidhi Charitable Trust

We are proud to announce that Sathiya Nidhi Charitable Trust has been awarded the ISO 9001:2015 Certification, a globally recognized standard for quality management systems. This certification reflects our commitment to providing high-quality arrangements for medical treatment and education to underprivileged children, orphans, and individuals with physical challenges.

Scope of Certification:

- Arrangements of Medical Treatment

- Education for Poor Children, Orphans, and Physically Challenged Individuals

Key Details:

- Certification Number: SAT23A1Q22IN

- Issue Date: 06/01/2023

- Expiry Date: 05/01/2026

- Surveillance Audits:

- 1st Surveillance Due: 05/12/2023

- 2nd Surveillance Due: 05/12/2024

Our certification was issued by BMG Conformity Assessment Services Pvt. Ltd., accredited by the United Accreditation Foundation (UAF). This milestone highlights our commitment to continuous.

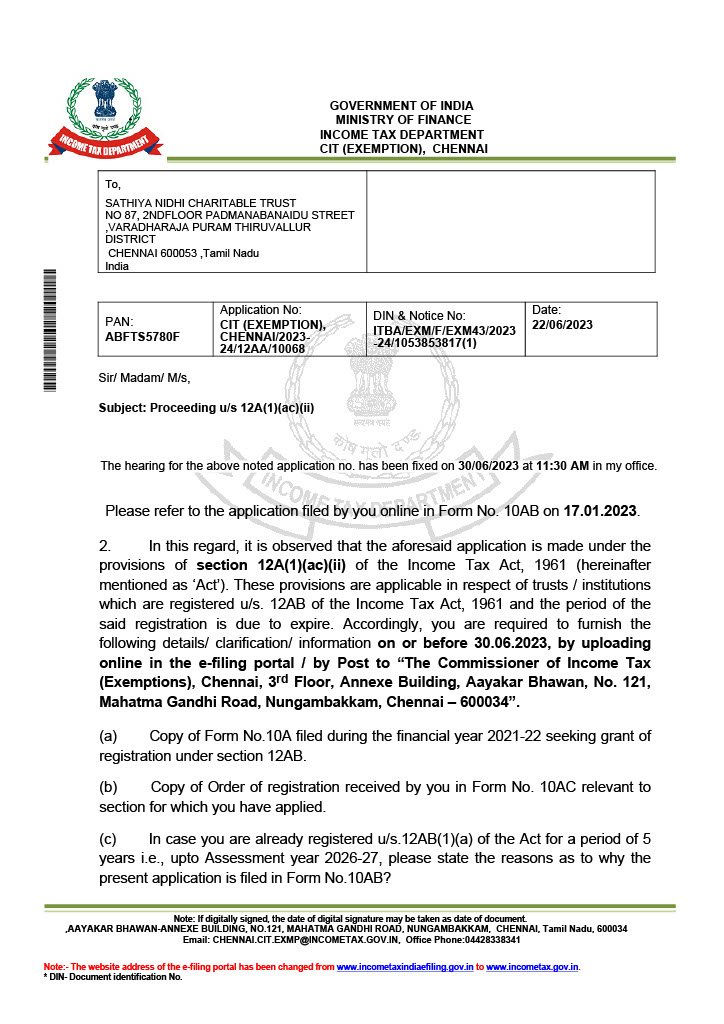

80G Exemption: Tax Benefits for Your Donation

When you donate to Sathiya Nidhi Trust, you are not only supporting a worthy cause but also benefiting from tax exemptions under Section 80G of the Indian Income Tax Act.

What is Section 80G?

Section 80G of the Income Tax Act provides tax deductions to individuals and organizations donating to certain approved charitable institutions and NGOs. Donations made to these entities are eligible for a deduction from the donor’s total income, reducing their taxable income.

Key Benefits of 80G Exemption

- Tax Deduction: Donations to Sathiya Nidhi Trust are eligible for a 50% deduction from your taxable income. For example, if you donate ₹10,000, you can claim a deduction of ₹5,000 from your taxable income.

- Eligibility: Both individual taxpayers and corporate entities can claim deductions under Section 80G.

- Documentation: After making a donation, you will receive a donation receipt from Sathiya Nidhi Trust. This receipt, along with the Trust’s 80G certificate, serves as proof of your contribution and must be submitted when filing your income tax return.

How to Claim 80G Deductions

Make a Donation: Contribute to Sathiya Nidhi Trust through any of the methods mentioned above.

Receive a Receipt: Ensure you receive a receipt for your donation. This receipt will include details such as the donation amount, date, and the 80G certificate number of Sathiya Nidhi Trust.

File Your Tax Return: When filing your income tax return, include the donation amount in the section for deductions under Section 80G.

Submit Documentation: Attach a copy of the donation receipt and the 80G certificate as proof of your contribution.

By donating to Sathiya Nidhi Trust, you can make a significant impact on the lives of underprivileged communities while also benefiting from the tax advantages provided under Section 80G.

12A

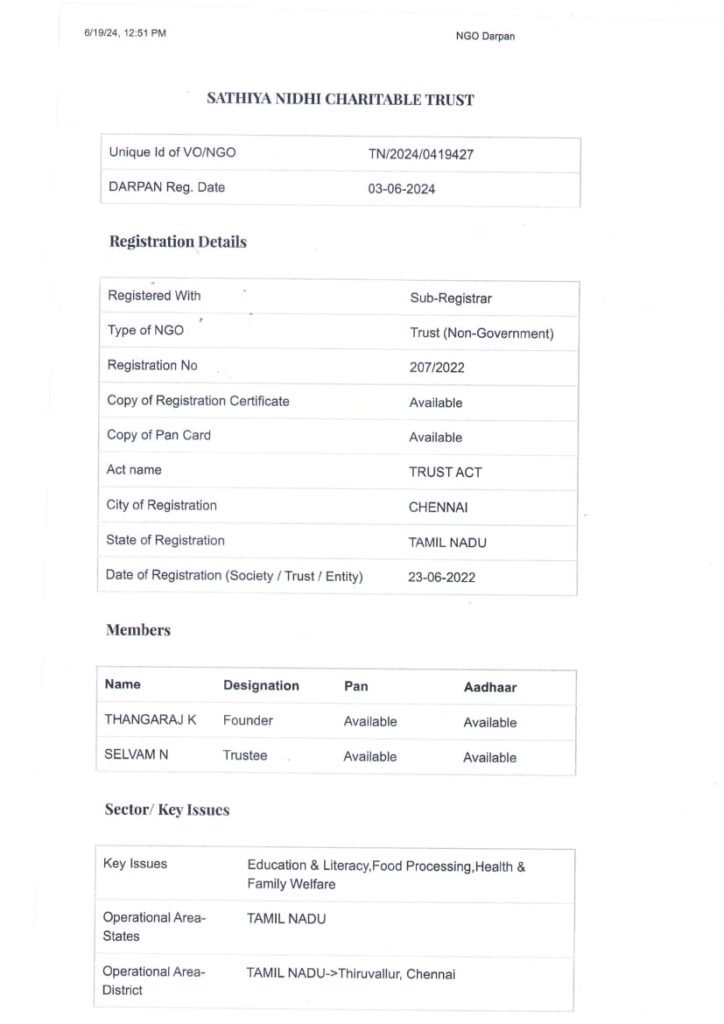

NGO Dharban

Trai License

This Telemarketer Registration is subject to the Terms and Conditions as Specified in “The Telecom

Commercial Communications Customer Preference Regulations, 2018” and guidelines to

Telemarketers specified by Vodafone Idea Limited.